All too often, we hear over the years that "the insurance market is saturated", "the insurance industry is a sunset industry", "there are too many insurance agents" or "I have too much insurance" and "I'm fully covered". But what does the statistics show?

Economically active* individuals in Singapore, despite being a developed market, have a combined S$893 billion (US$672 billion) mortality and critical illness (CI) protection gap, according to the Protection Gap Study (PGS) 2017 findings released yesterday by the Life Insurance Association, Singapore (LIA Singapore).

The report of the study, prepared by Ernst & Young Advisory, is a total of 87 pages. There are many articles available which you can find reporting on the findings. Read Asia Insurance Review's report on the findings here.

Here, we highlight two key findings and figures that you can use immediately for your next appointment.

1) 80% critical illness protection gap

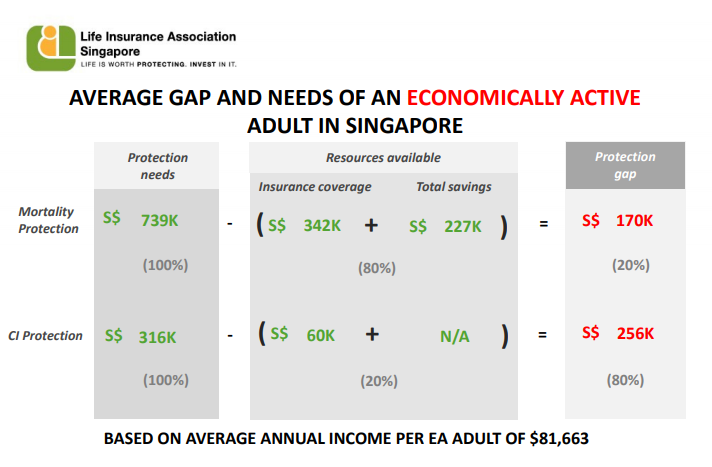

Singaporeans and permanent residents are covered for 80% of their mortality protection needs and 20% of their CI protection needs. Phrased in another way, there is a staggering 80% gap in CI protection coverage!

Do your clients have sufficient amount of CI protection? Use these figures to get the conversation going.

Average CI protection needs: S$316,000

Average CI protection gap: S$256,000

How can you help to bridge the critical illness protection gap?

According to the report, these are the key factors contributing to CI protection gap. And here's my take on what you can do.

Lack of understanding about what CI protection is, and the difference between CI and health insurance coverage. - Educate

Optimism bias and belief from individuals who do not foresee themselves being afflicted with a critical illness especially in the absence of genetic susceptibility. - Back up with stats

CI coverage being less of a priority, further compounded by the perceived costliness of getting such protection. - Provide options

2) Mortality protection gap up 35% even as insurance coverage increases (2012 vs 2017)

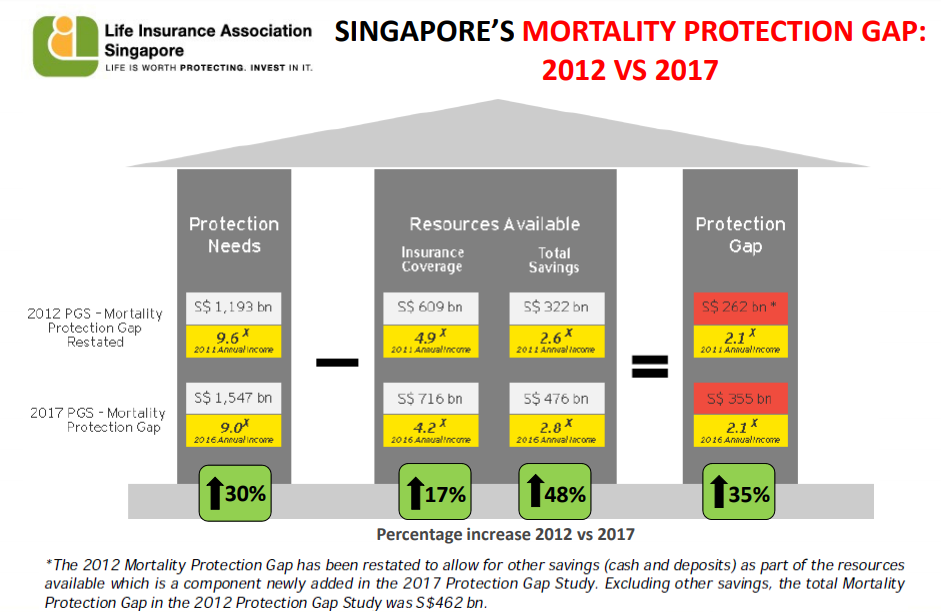

Between 2012 and 2017, the resources available for mortality protection grew: total savings went up by an impressive 48% and insurance coverage rose by 17%.

However, mortality protection gap still grew by 35% in the same period, because protection needs increased by 30% due to inflation and the rising costs of living.

Note: CI protection gap not included as the study in 2012 did not cover CI.

What does this mean to you?

The need for regular reviews: Financial planning is not something that you do it once and forget about it. Family circumstances change, needs change, and even if nothing else changes on your client’s end, external changes such as inflation and rising costs, may mean that their plans need to be amended as well. You know this, but now you have statistics to back it up.

More needs to be done: If you are an agency leader recruiting advisers. Or an adviser thinking about your future in the business. This shows that there is much work left to be done. While the industry has worked hard to increase insurance coverage by 17% in the period, it has simply not kept pace with the rising protection needs and gap. So more work still needs to be done, and the market potential is still immense for the professional adviser. And now, again, you have the statistics to back it up.

As Mr Patrick Teow, President, LIA Singapore, said, “While we are seeing positive increase in the uptake and awareness of life insurance, we recognise that the needs of consumers have gone up more than their allocated resources due to increased lifestyle needs and requirements, despite corresponding increase in income levels. So, it is important for individuals to bridge not just their mortality protection gap, but also their CI protection gap.”

*Refers to individuals employed and contributing to the production and distribution of goods and services.

Bonus: One page executive summary infographic for your presentation kit .