Sixty-nine percent of consumers in Asia expressed confidence in being able to retire and live the lifestyle they wanted, while only 50% of American consumers had that level of confidence, according to LIMRA Secure Retirement Institute (LIMRA SRI) which recently compared consumers' retirement readiness in Asia and the US.

One of the big differences LIMRA SRI found was the age at which consumers started saving for retirement and the age they expected to retire. In the US, the average age consumers started saving for retirement is 35 while in Asia the average age was five years older at 40. Even though they started saving later in life, consumers in Asia expected to retire at age 60, six years earlier than US consumers.

Despite the shortened time to save for retirement, more consumers in Asia (69%) are confident they will be able to live the retirement lifestyle they want than their US counterparts (50%).

In addition to higher levels of confidence, consumers in Asia are slightly less concerned with outliving their assets than US consumers. Thirty-one percent of consumers in Asia are not concerned at all about outliving their retirement assets compared to 24% of US consumers

Consumers from both regions were actively involved in planning for their retirement. About half of consumers have determined their income in retirement and just under half have determined their expenses in retirement.

There are some slight differences around health care costs. Only 34% of consumers in Asia have determined their expected health care costs in retirement while 40% of US consumers have determined theirs.

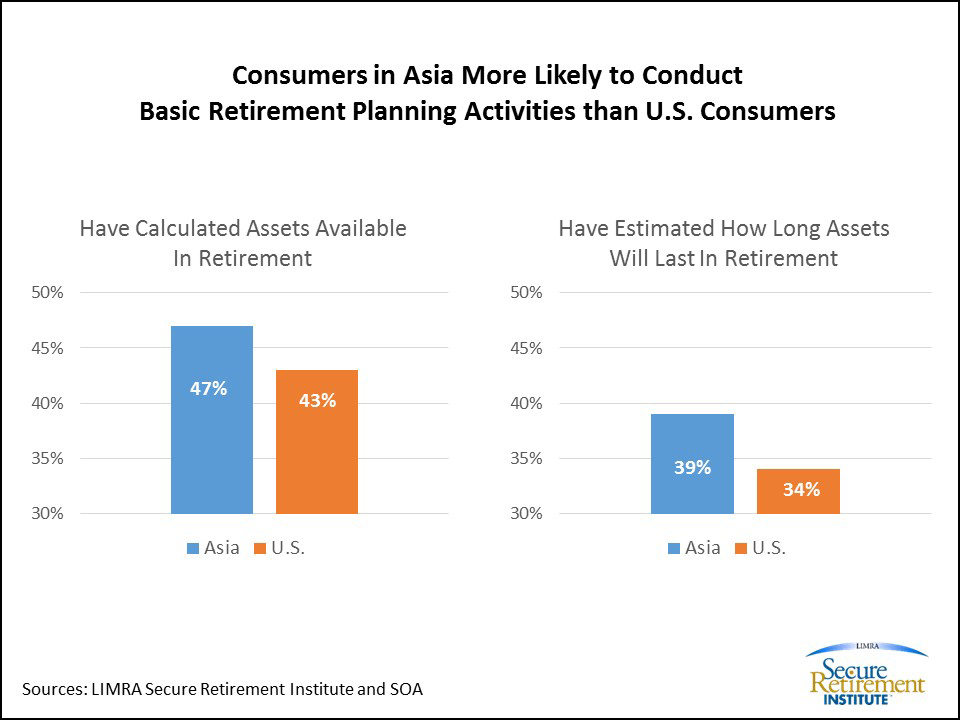

According to the study, nearly half of consumers in Asia (47%) have calculated the assets they will have in retirement, and 39% have estimated how long those assets will last. In the US, 43% of consumers have calculated their assets in retirement, and only 34% have estimated how long their assets will last in retirement.

More than half of consumers in both regions have not done basic retirement planning. This presents an opportunity for companies and advisers to reach out to consumers while they are working to help them save and plan for their retirement. Also, there is opportunity for companies to innovate products and practices.

The full report “Spotlight on Retirement: Asia” conducted by LIMRA SRI and Society of Actuaries is available here.

Read also:

Global insurance premiums up 1.5% to US$5 tln in 2017

The ageing challenge - The single biggest issue facing the insurance industry

More than half in Asia regret not saving earlier for retirement

Connect with us on Facebook and subscribe to our weekly newsletter here.