"... and they'll become docile as a puppy" used to describe insurance agents. By a national financial education programme, no less.

Truly heartbreaking and saddening that “puppy” was used to describe insurance agents by MoneySense, which is Singapore’s national financial education programme, started in 2003.

Puppies are cute. But I doubt the description was used as a compliment.

MoneySense programmes are overseen by the MoneySense Council.

The Council is co-chaired by the Monetary Authority of Singapore and the Ministry of Manpower, and comprises representatives from various government agencies.

A National Financial Education Programme for Singapore, MoneySENSE is spearheaded by the public-sector Financial Education Steering Committee (FESC). It comprises representatives from the Ministry of Social and Family Development, Ministry of Education, Ministry of Manpower, Central Provident Fund Board, Monetary Authority of Singapore, National Library Board and People's Association.

So what was the message that caused unhappiness among the insurance community?

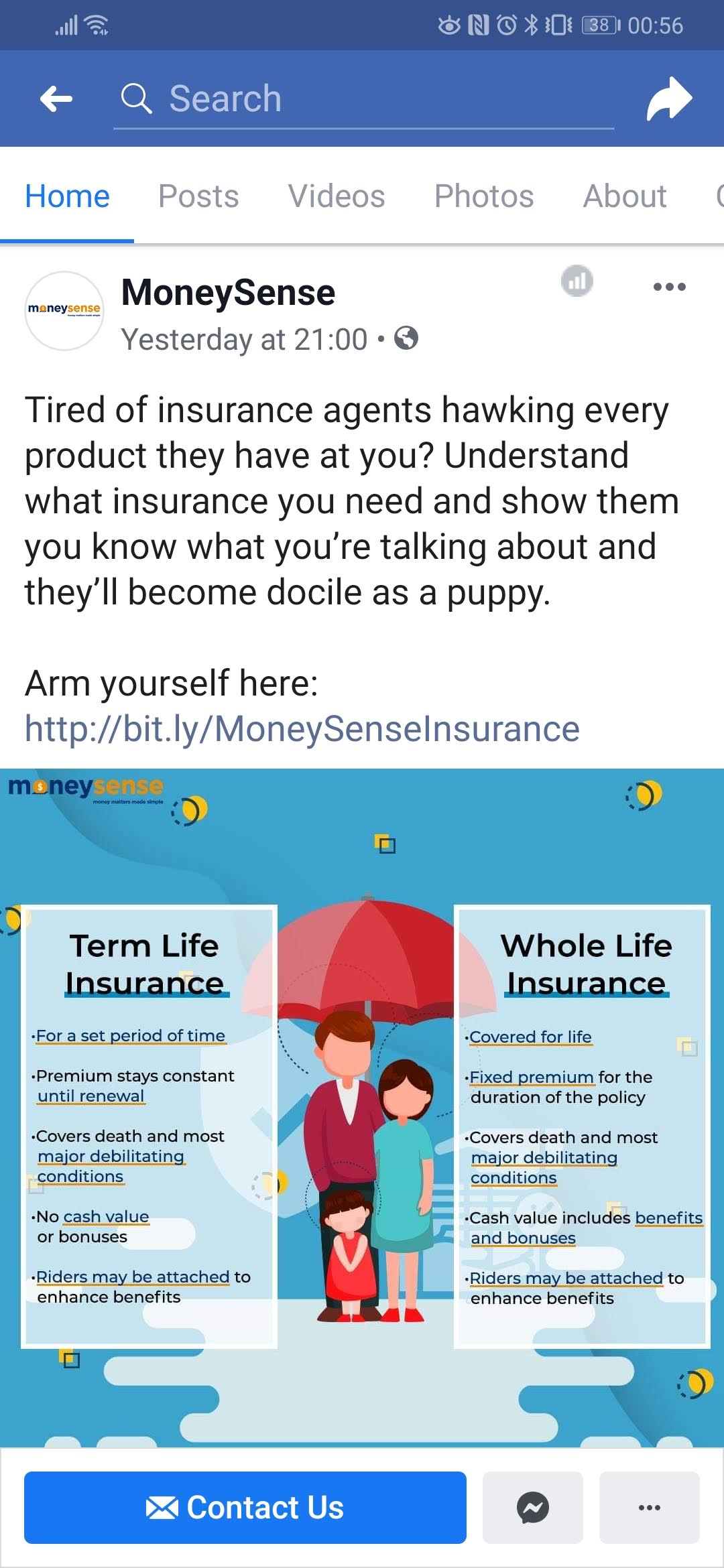

This.

“Tired of insurance agents hawking every product they have at you? Understand what insurance you need and show them you know what you’re talking about and they’ll become docile as a puppy.”

(Screen grab from MoneySense facebook page.)

Naturally, it caused unhappiness among many professional agents and advisers who saw it.

Other than “docile as a puppy”, many took issue with this as well “hawking every product they have at you”.

Let it slide or make a stand

The point of this post is not to get the person or organisation behind this post in trouble.

At the time of this posting, the post has been taken down.

So it must have received feedback regarding the post, and it has listened to the feedback and took action to rectify it.

And there are plenty of brilliant educational articles on MoneySense.

But at the same time, this episode holds a great lesson for all.

If looking at some infographics and reading some blog posts can make a reader a financial expert, then why are financial representatives required to pass the necessary competency examinations before being licensed?

The issue I have is when financial education programmes or many other journalists and experts make insurance agents and financial advisers the “enemy”.

That shouldn’t be the case.

There are many professional agents and advisers who are out there doing their utmost best in helping society narrow the protection gap and plan for their desired financial goals.

Don’t write off all financial representatives because of some bad apples in the industry. Which industry doesn’t have any?

Here are the good apples

Do you need examples of “good apples”? Check out the winners of Asia Trusted Life Agents & Advisers Awards - the Awards with an independently-audited judging process with some 30 judges on the judging panel made up of CEOs, senior executives, association heads and industry experts. There is plenty for you to choose from.

Susanna Chan, winner of Inspirational Leader of the Year 2019, advocate and top contributor to the LifeCare Movement, a campaign targeted at helping the underprivileged by having clients donate part of their policy claims to a charitable organisation of their choice.

Amy Wat, winner of Insurance Agent of the Year 2018, at the time of her win a 100% policy persistency rate over the prior five years. And over the prior eight years, the only year in which she fell short of her high standards was when her persistency rate was 99.88%.

Isabelle Oh, winner of Financial Adviser of the Year 2019, who despite her success, continues to live a simple and contented lifestyle as a living example to educate her clients on financial planning.

Agnes Ng, winner of Rookie Insurance Agency Leader of the Year 2018, who grooms a team of high-quality professionals with an emphasis on quality advice. At the time of her win, she has a personal persistency rate of 100% in the prior year and a group persistency rate of 99% for her team.

Many more. Beyond the Awards, I’m sure there are many other passionate and professional agents and advisers out there.

Partners, not adversaries

So how do we move forward?

- Partner the insurance industry, especially agents and advisers

These are the people who are out there talking to people and reaching those that most financial education programmes will not be able to reach.

Provide them with more resources and materials, and professional advisers will gladly help to educate and bring the message to the wider community.

- Don’t demonise agents and advisers

Those who are reading online and researching, these people are usually the “converted”. They are likely to have the motivation, drive, time or ability, to educate themselves and to make sound decisions.

That’s wonderful. But not everyone can or has the ability to do so.

By demonising professionals who are able to help them, you plant fear in them to get started and, worse still, lead them to make the wrong decisions when they are not equipped to make sense of things.

- The insurance community must expect more

The insurance community of agents and advisers must expect more of themselves and peers as well.

Continuous education, professionalise and always do the right things. Agents and advisers must be more knowledgeable to continue to add value to a client’s financial journey.

For those who fall afoul of the rules and regulations, they should be rightly penalised.

- Stand up and be counted

The Asia Trusted Life Agents & Advisers Awards and Asia Advisers Network were created to shine the spotlight on the good that professional agents and advisers do.

Be part of the community to share ideas, and also showcase to the general public the good that fellow practitioners do in the region.

Have a story to share? Have an idea that will benefit the industry? Have a testimonial from a client to share? Reach out to #TeamAAN Email: Connect@AsiaAdvisersNetwork.com

Sign up for our newsletter if you haven’t, and get social with us: Facebook / LinkedIn / Soundcloud / YouTube / Instagram

Together, we can do more for the industry. And ultimately, serve society better in narrowing the protection and savings gaps.

Connect with me on LinkedIn.