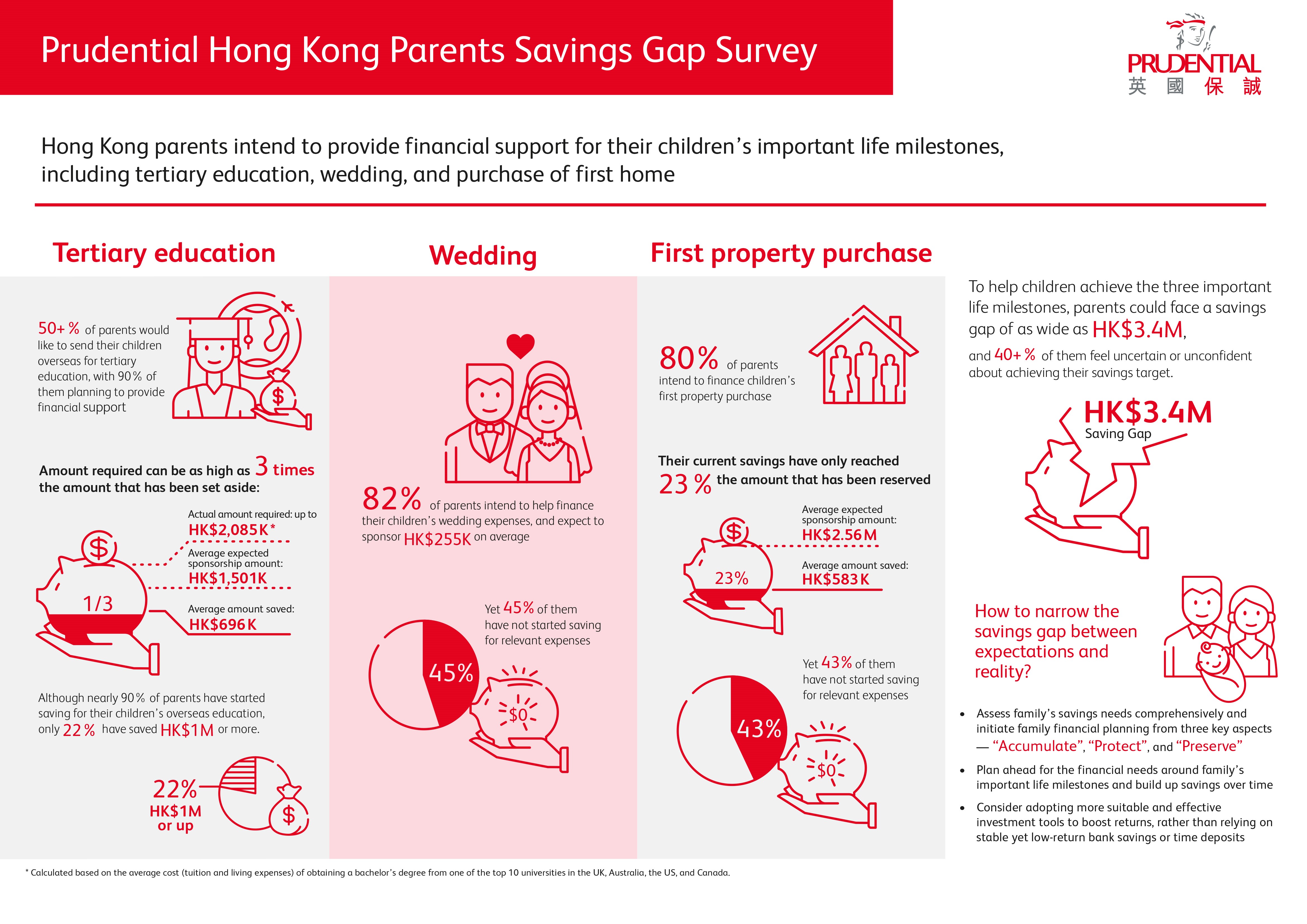

According to Prudential's Parents Savings Gap Survey, Hong Kong parents are keen to help finance their children's higher education, wedding and purchase of their first home, but face a significant savings shortfall of up to HK$3.4 million.

The survey was conducted to identify the gaps in the preparations undertaken by parents to support their children financially through major life milestones.

The study, which was conducted by ABN Impact with 753 parents interviewed, found that:

(Credit: Prudential Hong Kong)

• Overall savings gap: Hong Kong parents are keen to finance their children’s major life milestones such as their education, wedding and purchase of their first home; yet they are facing a shortfall of up to HK$3.4 million (US$433,585) to meet the cost.

• Tertiary education: The total amount required to complete a bachelor’s degree abroad can be as high as three times the amount parents have put aside for their children’s education.

• Wedding and property purchase: More than 40% of parents who plan to financially support their children for their wedding and property purchase have yet to put any money aside for these milestones.

• Continuous support beyond young adulthood: Over half of the surveyed parents would like to continue providing financial support to their children in addition to their tertiary education, wedding and a property purchase, with one-third planning to support their children beyond the age of 25.

• Investment tools: Bank savings and time deposits are the most popular investment vehicles used by the surveyed parents in accumulating wealth for their children.

Priscilla Ng, Chief Customer and Marketing Officer at Prudential Hong Kong, said the survey shows that Hong Kong parents want to do the best they can to financially support their children. However, many of them are financially unprepared to do so, with more than 40% lacking confidence in achieving their savings goals.

Helping parents to bridge the gap

Prudential Hong Kong has launched PRULife HeadStart Saver Series. It is designed to help parents to bridge the savings gap to support their children’s major milestones in life and build a solid financial future for the family. The Series offers guaranteed cash coupon payouts that will help fund their children’s higher education and enable them to accumulate wealth through whole-life savings.

(From Left) Priscilla Ng, Chief Customer & Marketing Officer of Prudential, Derek Yung, CEO of Prudential, and Sady Wong, Senior Director, Product Management of Prudential (Credit: Prudential Hong Kong)

PRULife HeadStart Saver Series gives customers the flexibility to tailor their savings plan. Through PRULife HeadStart Education Saver, policyholders can opt to receive four guaranteed cash coupon payments, one on each policy anniversary following the child’s 18th, 19th, 20th and 21st birthday. Alternatively, PRULife HeadStart Dream Saver offers a single guaranteed payment on the 20th policy anniversary.

PRULife HeadStart Saver Series is also designed to deliver benefits after the guaranteed cash coupon payouts, by offering policyholders potential returns through a guaranteed cash value and non-guaranteed Terminal Dividend, which allow them further accumulate wealth and boost their long-term savings.

Other key features of PRULife HeadStart Saver Series include:

• Premium payment period of either five or 10 years

• Complimentary Academic Success Award if the child meets specific educational achievements

• Guaranteed Insurability Option to take out a new whole-life insurance plan with cash value when the child reaches the age of 21, with no health information needed

“Our unique suite of savings and protection solutions, value-added services and comprehensive resources underpin our proactive role in addressing the unmet and evolving needs of families in Hong Kong, as we work towards empowering parents to give their children the best start in life and plan for a bright future,” said Derek Yung, CEO of Prudential Hong Kong.

Read more:

#OneMoreHour of sleep for healthier, longer, better lives

#MDRTGC2019:Embrace the Whole Person concept

Australia:60% believe removing commissions will increase underinsurance

Skilled for 100 - Leveraging an older workforce in Singapore