Allianz unveiled its latest Global Insurance Report, taking the pulse of insurance markets around the world by looking back at last year's performance and looking ahead at future developments.

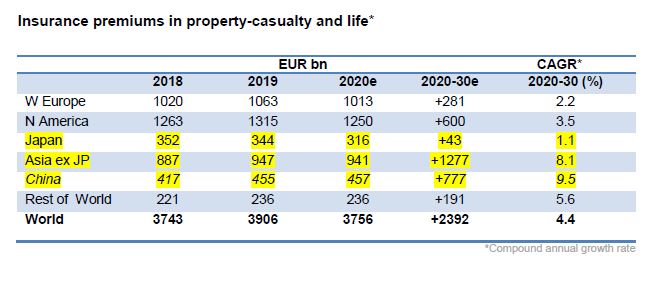

The global insurance industry entered 2020 in good shape: In 2019, premiums increased by 4.4%, the strongest growth in four years. The increase was driven by the life segment where growth sharply increased over 2018 to 4.4%, as China overcame its temporary, regulatory-induced setback and mature markets came finally to grips with low interest rates. Extracting life insurance details from the report, the Global Life premium income totalled EUR 2,399bn.

However, with the outbreak of COVID-19, the world economy took a hit with the sudden stop of economic activity around the globe, affecting insurance demand, too. Global premium income is expected to shrink by 3.8% in 2020, with life insurance probably hit more than Property-casualty insurance with growth rates of -4.4% and -2.9%, respectively.

In the report, the impact of COVID-19 is going to be three times stronger than that of the global financial crisis, when global premium income decreased by 1.0%. Compared to the pre-Covid-19 growth trend, the pandemic will shave around EUR 250bn from the global life premium pool.

Ludovic Subran, chief economist of Allianz said, “More interesting is the question about what comes after Covid-19. Basically, we see three trends, already in place before that will gather steam in the coming years: Digitalization of the business model, the pivot to Asia and the growing significance of ESG-factors."

He added, “While Asian players lead in technology, European peers are ahead with ESG. But the dominance of the global insurance industry will be decided in Asia – Asian households emerge as the consumer of last resort, driving global insurance demand.”

According to the report, Asia (ex Japan) clocked growth of 6.8% in 2019, more than twice the rate of the year before. Life and P&C segments contributed to the increase in premiums: Life grew by 6.5% and P&C by 7.5%. Total premiums reached EUR 947bn in the region, almost half of them written in China.

Source: Allianz Global Insurance Report

Meanwhile, for 2020, Premium income in Asia is expected to decline by 0.7%, with life insurance shrinking by 1.8%. Allianz reports long-term prospects will look brighter - the region will return to its “normal” growth and see an average growth rate p.a. of 8.1% until 2030; life and P&C are expected to grow at the same speed. This is almost twice the speed of the global market (4.4%).

Asia Advisers Network is organising a virtual summit "Insurance Inspired: Winning in the New Normal" that is happening on 28-30 July 2020 as the first batch of speakers has been announced. Co-Organised by Jensen Siaw International and sponsor GoalsMapper, the summit will feature prominent international speakers across three days. There are over 1,00 sign ups now, so hurry and reserve your virtual spots today! https://bit.ly/InsuranceInspired

Want to win a Fitbit?

Predict the winners of the 5th Asia Trusted Life Agents & Advisers Awards 2020. Try your luck here. A lucky winner with the most correct predictions stands a chance to win a Fitbit worth USD 198.

They say reading will cultivate your mind:

Living in a technologically-advanced age

Change is the Way of Life

AIA and EY reports 90% of HNWIs in Singapore leverage on insurance for their wealth and legacy planning

For the full suite of stories and updates, always check in to our Facebook / LinkedIn. Click the following if you want to improve your sales, learn how to be a better leader, or you just need some motivation to kick start your engine.

Do you have a new product or programme to share? Or perhaps you are keen to explore any collaborations with us or our partners? Reach out to us at Connect@AsiaAdvisersNetwork.com