This article is in no way trying to minimize the medical and financial horrors inflicted around the world by the COVID-19 pandemic. But before most of the world ever heard of a coronavirus or COVID-19, there was a different global crisis, albeit less immediate than the current pandemic, says Ronnie Klein, Executive Director of Bermuda International Long Term Insurers and Reinsurers (BILTIR), which represents Bermuda's life and annuity sectors. He shares his insights in this article.

While now taking a back-seat to the onslaught of this invisible disease spreading across the world with the fury of a tidal wave, this worldwide issue has the potential to cause a much slower devastation to economy and “normal life”.

Old-Age Dependency Ratio

The ageing population in most mature markets with a combination of increasing longevity and record low fertility rates, has been slowly threatening social insurance systems. Countries have been attempting to combat this issue with increasing normal retirement ages, raising contribution rates and cutting benefits. Some countries are already discussing a “needs test” to qualify for benefits. It is clear that these pay-as-you-go pyramid schemes just do not hold up when fertility rates decrease.

Fertility rates are calculated by taking a snapshot of women in their childbearing years (typically ages 15-49) and calculating the number of children born to each age group. This estimates the number of children born to a hypothetical woman passing through her childbearing years. As a first guess, most people would assume that a fertility rate of 2.0 would be sufficient to maintain the population (one child to replace the mother and the other to replace the father). However, due to infant mortality and the potential for a woman not to survive to age 49, the replacement fertility rate is commonly set to 2.1.

Read also: Asia Pacific: A Hub for Silver Market Opportunities

According to the World Bank, South Korea has the lowest fertility rate equal to 1.1. Japan is also very low at 1.4. In fact, 4 of the lowest 5 reported countries are in Asia. Moving to Europe, Germany is below replacement at 1.6 as is France at 1.9. North America is no better with Canada at 1.5 and the US at 1.8. The entire world is still above replacement at about 2.4 due to some poorer nations having higher rates such as Niger at 7.0 and Somalia at 6.2. Projections are even bleaker showing that the entire world will be just above the replacement rate by 2050.

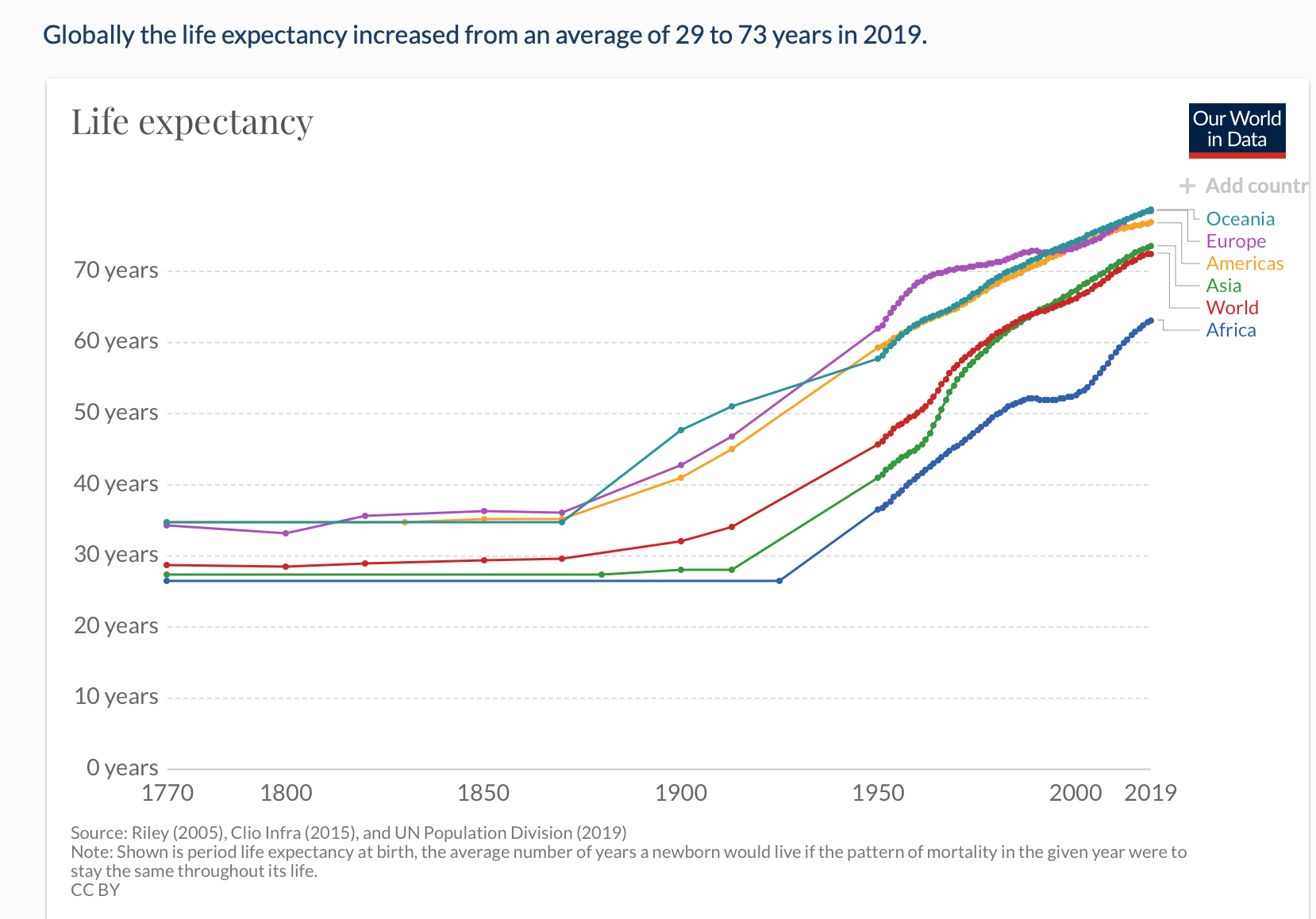

Longevity, on the other hand, continues to increase.

One look at Chart 1 tells the entire story.

Much of the increases through the 1990s can be attributed to reduced infant mortality and anti-biotics. These breakthroughs dramatically increase life expectancy because they save many years of life. More recently, advances in medical technology at older ages have kept life expectancies increasing at older ages. Asian countries claim 3 of the top 4 spots, according to the World Bank.

Even though fertility rates are so low, the world population is projected to increase through the end of the century, but then it should decline. Certain countries have already experienced a decrease in population and this is projected to accelerate. While immigration of younger people can improve the population growth of one nation, it will be offset in another nation. The only real way to stem this tide is an increase in fertility rates. Some countries have tried incentives such as enhanced childcare benefits with little effect. And, it is well documented that China eased its “One Child” policy recently, but this has also been relatively unsuccessful to date.

The main problem with the combination of increased longevity and decreased fertility rates is what is called the old-age dependency ratio. The most typical calculation is the number of “retirees” defined as people aged 65 and older, divided by the number of “working people” defined as those aged 15-64. This calculation has many flaws, but it does give an indication of how many working people there will be to support the elderly population. The lower the percentage, the better for social insurance systems.

According to the Organization of Economic Cooperation and Development (OECD), the old-age dependency ratio for OECD countries is currently approximately 32%. That is, there are approximately 3 workers for every retiree. By 2050, it is estimated that there will be fewer than 2 workers supporting every retiree. This puts a huge strain on the workforce and also on governments to continue to fund social insurance benefits. These benefits, called Social Security in the US and Pillar I in most other countries, are mostly funded on a pay-as-you-go basis from current employee contributions. With more retirees and a decreasing workforce, the pressure will become too great for governments to withstand.

Check this out: Here's another reason for critical illness insurance - the impact on caregiver's career

Pay-as-you-go systems, sometimes called generational shifting, were devised when fertility rates were relatively high. It was just assumed that there would be an endless flow of new workers to fund the retirees. This is very much akin to a Ponzi Scheme, which must implode at some point. What is interesting is that this issue has been forecasted by demographers for decades. It is what one executive at a major US insurance company called a “predictable surprise.”

Fertility Rates

There are many theories as to why fertility rates have been declining. Some are based in fact and others in supposition.

The most widely cited are:

- An increase in GDP per capita|

- More women in the workforce

- Population urbanization

- Financial concerns

Studying these hypotheses carefully will show that fertility rates drop before countries experience an increase in GDP per capita. Therefore this cannot be a primary cause. The number of women in the workforce has not materially changed from the 1960s until now. However, the earnings gap between men and women has been steadily closing. A better way to state bullet point 2 is that women are attaining better positions and earning more income, thus, are having fewer children. There definitely is merit it this theory. The CEO of a major insurer in Taiwan recently said: “Women have better jobs now. Why would a woman lower her standards and get married?” Obviously, this CEO has a few daughters and is not comfortable with any of their suitors.

Population urbanization is a key component as about 2/3 of people lived in rural areas in the 1960s, but this has reduced to about 45% currently. Living in cities means smaller living quarters, much higher costs and no need for a large family to “work the soil.”

It is difficult to gauge if financial concerns will lower fertility rates. During the past 20 years, the world has gone through some major events and recoveries with fertility rates dropping straight through the rollercoaster. While it seems to be a plausible cause, the data does not seem to support this concern.

A Possible Solution

Is it possible that life has gotten just too darn busy? Is it possible that there is just not enough time for children? Is it possible that between commuting, being available 24/7 by email and text, having aging parents and having access to friends and family around the world, there is no room for children?

What if something unforeseen happened to the entire world causing people to be locked up inside their dwellings with nothing but time? What if 24-hour news cycles were repetitive and boring. What if young couples decided that they needed to make some good news of their own? What if people started to think a bit about the future instead of themselves and the present? Could this possibly cause another baby boom?

More insights: Data & Analytics: An Insurance Perspective

The current COVID-19 pandemic may just be that “what if.” An unforeseen event is causing people to be locked up in their own dwellings with nothing but time. There is no “wasted time” commuting, people are tired of watching the news cycles trying to talk about a worldwide pandemic as “breaking news” and many are looking for some good news. Is it possible that, given this time together, young (and not so young) couples will decide to bring a baby into the world? Stranger things have happened. And, if so, this could be the fertility boost that most mature markets are craving for.

Again, this is not to belittle the death caused by this disease, but the disease does seem to currently have its greatest mortality effect on the elderly. In some countries, the median age of death is over 80. While the numbers are in no way large enough to cause a major blip in statistics, we have a disease that is shortening lifespans at older ages and could possibly increase fertility rates. Perhaps this is nature’s way of solving a problem as there is no way that the civilized world could have devised this plan.

So, while a terribly frightening disease is distressing the world, a baby boom may just be on the horizon. With a slight decrease in longevity combined with this increase in fertility rates, one looming financial problem could be solved – in just a few months. This could just be the silver lining to a terrible crisis.

Ronnie Klein, Executive Director of Bermuda International Long Term Insurers and Reinsurers (BILTIR), which represents Bermuda’s life and annuity sectors. He has over 30 years’ experience in the Global Life Insurance industry. Klein formerly served as the secretariat for the Global Reinsurance Forum and director, Global Aging of the Geneva Association in Zurich.

Connect with us to get the latest: Facebook / Instagram / LinkedIn / Soundcloud / YouTube /