The COVID-19 pandemic has had a major impact on almost all economic sectors, and insurers are no exception. While governments are limiting the damage by stepping in as insurers of last resort, the pandemic is still unfolding, and customers are currently focused on preserving their health rather than actively lodging claims. In time, as the overall environment improves, we expect the underlying impact on insurers' underwriting performance to become clearer. Angat Sandhu and Prasanna Patil from international management consulting firm Oliver Wyman share their insights.

While the consequences unfold, insurers should prepare for the future, by accelerating the digitization of their operations and planning for emerging business opportunities. To do this effectively, they need to understand the likely impact of the pandemic across a range of scenarios.

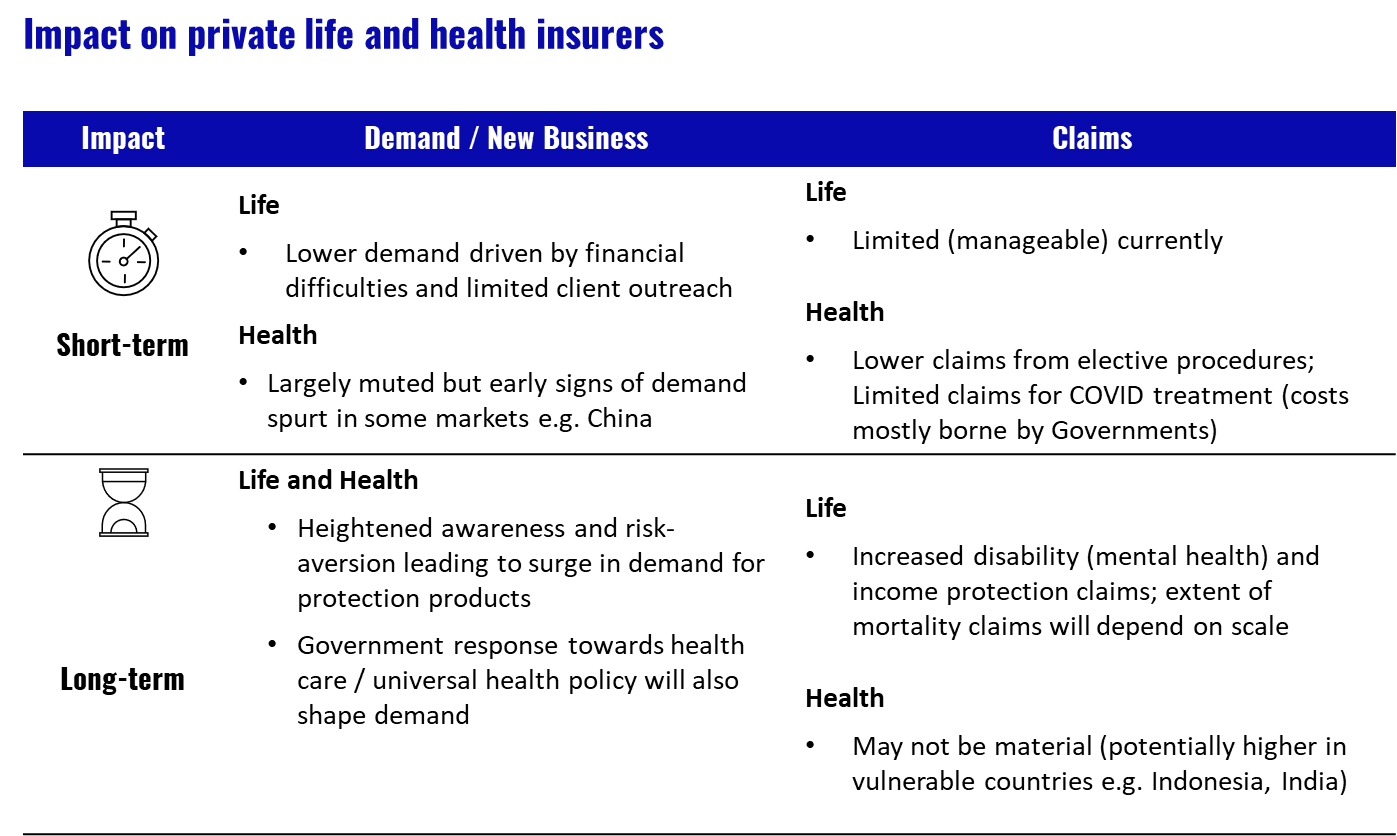

We expect different lines of business to be impacted to varying degrees over time. Initially, new business growth for Life products will decline, as potential customers are hit by financial difficulties. Life and Health claims may start growing depending the scale of the pandemic and the ability of health systems to cope with volumes. Over the next few months, we expect a surge in demand for insurance as people become averse to risks, particularly to life and health, and purchase insurance to protect themselves (see Exhibit below).

Life Insurance

A spike in COVID-related life claims will impact insurers across the region, with increased disability / income protection and mortality claims. The relative magnitude of each claim type will vary across markets and be determined by the policy coverage, the economic impact on each market, and the number of mortalities. Some insurers have quickly changed their coverage provisions on new business, but that will have a minimal impact relative to their existing business.

To date, life insurers have extended free COVID-related death benefits to policyholders, or customers of B2B2C or ecosystem partners like banks and WeChat. Insurers with large agency channels, are rolling out tech-driven initiatives to equip agents with digital apps to enable real-time responses to customers and offering digital training to agents. Regulators are also playing an active role in addressing the crisis e.g. in Singapore, the MAS has mandated insurers to allow premium deferment for up to 6 months. In China, the CBIRC is offering fast-track approval to launch low-priced products covering COVID treatment that are 15-30% cheaper than traditional products. In Indonesia, the OJK is working with the Life Association to remove wet signature requirements for sale of unit-linked products.

Health Insurance

In several markets – notably China, Japan, Korea, and Singapore – medical expenses from COVID-related treatment are currently being borne by governments. The impact on private (individual) health insurers in those markets is therefore likely to be limited. In the Group segment, Employee Benefits insurers have not seen a spike in Out-patient or In-patient claims to date. There is typically a time-lag for making health claims however, and this situation might change in the 2nd or 3rd quarter. One highlight is the ~5-10x growth in tele-consultations observed since the outbreak. Also, medical claims for elective / non-essential procedures have reduced across the region.

However, in countries with large vulnerable populations, such as India and Indonesia, the impact on private health insurers could be higher. Despite lower penetration of health insurance, a volume-driven spike in medical claims could be a significant cost for private insurers.

Insurers have responded by offering free hospital cash benefits and telehealth consultations to customers. In India, the IRDAI has mandated insurers to offer a standard health policy to cover hospitalisation costs for treating infectious diseases like COVID.

The heightened awareness of life and health risks will likely result in a surge in demand for life and health products in several markets. Historically, in the six months after SARS, health insurance premiums more than doubled in China. In January 2020, health business grew fastest at ~18% and 27% YoY respectively for the life and property sectors.

The Way Forward: Shifting Priorities

To date, insurers’ priority has been to respond to customer and employee needs, and to assess the business impact. However, even before they know the probable fallout, insurers should take the following steps:

- Consider a range of scenarios and the impact these will have on their businesses. Then formulate response plans.

- Increase client outreach by using digital distribution channels and working with partners. Remind customers – actual and potential – of the importance of insurance in challenging times.

- Accelerate their own digital transformations.

The insurers that emerge successfully from this crisis will be those that serve their customers in their time of need, while revising their business model for the post COVID-19 world.

Read also: Financial planning tool GoalsMapper sees 70% spike in users

About the authors:

Angat Sandhu

Partner at Oliver Wyman, Financial Services Practice

Angat Sandhu is a partner in Oliver Wyman’s Financial Services Practice and leads their Asia Pacific Insurance Practice. He is an actuary, a holder of the right to use the Chartered Financial Analyst designation and the Financial Risk Manager designation.

Prasanna Patil

Principal at Oliver Wyman, Financial Services Practice

Prasanna Patil is a principal in the Insurance practice at Oliver Wyman. Prasanna has over 20 years of industry and consulting experience in insurance (Life, Health, P&C) and financial services across Asia, Europe and the Americas.

Download The Best of Asia Advisers Network - interviews with John Maxwell, Chris Gardner, CEOs and more...

Recommended for you:

MDRT Virtual Event details announced

AIA Singapore: Medical claims pre-authorisation process as easy as 1, 2, 3

Confined to a wheelchair but not resigned to fate